- #Does venmo charge a fee how to#

- #Does venmo charge a fee code#

- #Does venmo charge a fee trial#

- #Does venmo charge a fee password#

- #Does venmo charge a fee free#

#Does venmo charge a fee password#

#Does venmo charge a fee code#

Type the confirmation code in the Venmo screen.Select the Send code button to receive a confirmation code.If you don’t already have a Venmo personal account, you’ll need to open one by either downloading the Venmo app or navigating to Venmo’s website and clicking Get Venmo. To set up a Venmo for business profile, simply click the icon in the bottom right of your Venmo app (the one shaped like a person and dollar sign) or the Create a business profile link in the left navigation bar on the website or in the upper right of your profile screen in the app.

#Does venmo charge a fee how to#

How to create a Venmo for business profile Get secure formal tax documentation that meets or exceeds both state and federal reporting thresholds.

#Does venmo charge a fee free#

Receive a free quick response (QR) kit of lanyards, stickers, wallet cards, and a tabletop display containing a unique code you can post or hand out to customers for even faster, more convenient payment options.

#Does venmo charge a fee trial#

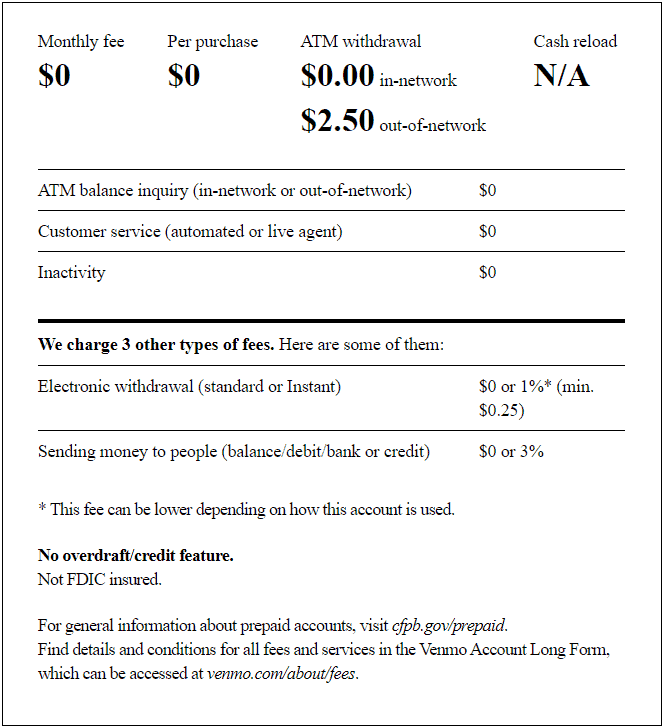

In fact, for every payment the business owner receives that’s $1 or more, Venmo will only charge a nonrefundable seller transaction fee of 1.9 percent plus 10 cents.Īlthough Venmo used to offer new business profiles a trial period of 30 days without seller transaction fees, these Venmo charges now begin once you receive a payment that’s $1 or more - regardless of business size or industry. Like Venmo’s personal account, Venmo charges aren’t excessive for business profiles. One of Venmo’s biggest cons, however, is its accessibility: Both its personal and business accounts are currently only available within the United States. An overview of Venmo for businessīuilt for small and medium-sized businesses, associations, and clubs, Venmo for business helps companies just starting out - those with less capital and social reach - boost their visibility and develop new referrals among current Venmo users.

However, you do need a personal account with Venmo if you’d like to have a business account, and Venmo strictly prohibits any form of business transactions on personal accounts.įortunately, you can create and store both profiles under the same login, which will keep your personal and business transactions separate. What’s more, in addition to holding a free personal account with Venmo, you can even open a business profile to accept and manage customer payments.

0 kommentar(er)

0 kommentar(er)